Statistics on Canadian Family Enterprise

You have the characteristics of a healthy family enterprise

Congratulations for having the characteristics of a healthy family enterprise. Family enterprises are a critical component of the Canadian economy. Drawing on data from Family Enterprise Canada[1], family-owned businesses account for 63.1 per cent of all private sector firms in the Canadian economy and generated 48.9 per cent of Canada’s real GDP in the private sector, at $574.6 billion. They also employ 6.9 million people across the country, which is equivalent to 46.9 per cent of private sector employment.

Continuity

While family-owned businesses are a significant driver of employment and wealth in Canada, there is an upcoming wealth transition across the country that threatens to diminish family-owned businesses impact on the Canadian economy, as described in Family Enterprise Canada’s Ready, Willing, and Interested – or Not? report. Keep in mind, as we have previously stated, the continuity journey ‘it’s a hard, it’s a hard,’ and the articles that accompany the decision tree will expand on the learnings of these statistics. It is not enough to be a healthy family enterprise today, as to continue on this path for future generations requires a lot of foresight and careful planning. That is where the services of an expert Family Enterprise Advisor, and a multidisciplinary team of professionals working together can help.

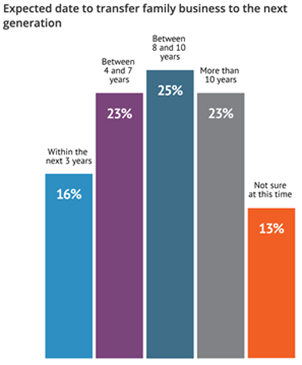

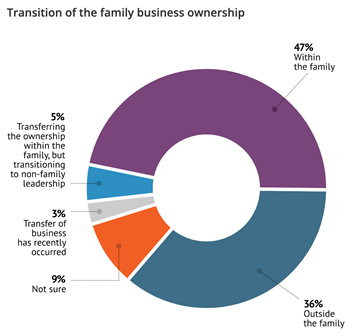

| The Clock is Ticking It’s more important than ever to start thinking about continuity plans. It’s estimated that within the next ten years, over 60% of family enterprises will be changing ownership. Within seven years, research is estimating that around 40% of family business will experience ownership transitions. The earlier you start continuity and succession planning, the better. | Family in or Family out? Most Canadian family businesses intend to keep their business in the family. Just over 50% of families have indicated that they intend to transfer ownership of the business to family members. There are however, leaders (around 36%) who are not opposed to transitioning ownership to non-family member, for reasons such as lack of interest and inexperience from family members. |

Family Legacy and the Next Generation

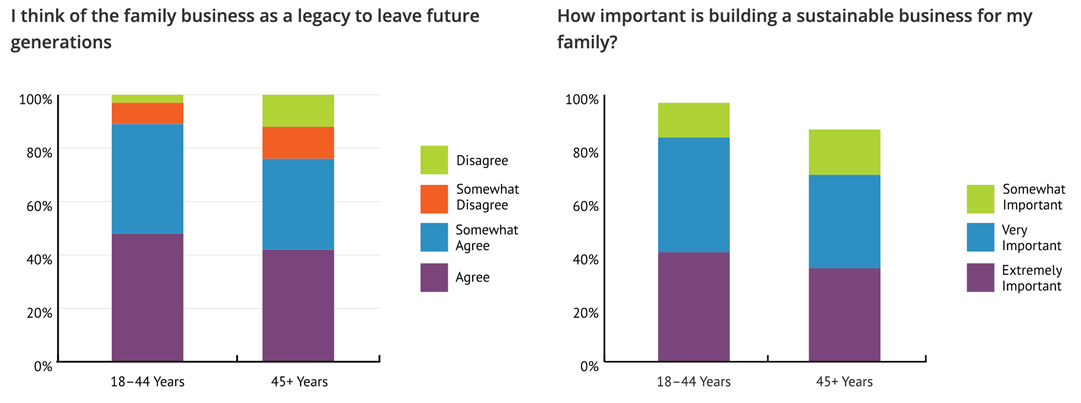

In FEF’s second continuity report, Who are the Guardians of Family Legacy?, the research identified a generational shift that challenges the notion that the next generation is not ready, willing or interested in taking over the family business. Where the family business is sold off, the reinvestment of the sale proceeds can create a great opportunity to regroup as family office or family investment office for future generations, with or without outside professional management.

| Loyal, Committed and Driven The research found that the next generation who are currently involved in their family businesses are generally in favour of retaining family control of the business. | It’s our legacy The findings also indicate that 89% of younger respondents agree that the family business is a legacy to leave to future generations. |

There is a passion for and a commitment to continuing a legacy, yet legacy itself is interpreted differently from family to family. To some families, it means continuing to build wealth. For others, it means continuing the family business or a set of values that they wish to continue to the next generation.

Governance

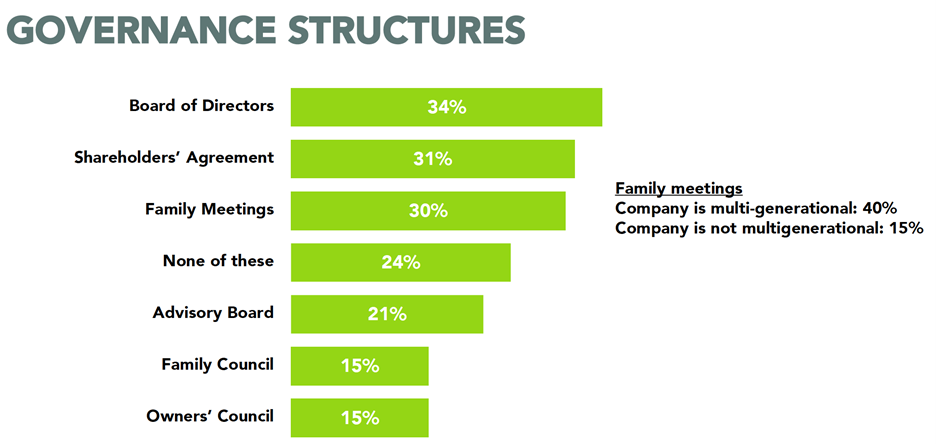

Through these statistics, we see evidence of a gap between the continuity intentions of the senior generation and next generation of family business owner. Missing conversations are not uncommon in family businesses, but there are different avenues available to family businesses to discuss these sensitive topics in a safe space.

The main issue is our research indicates that family governance structures are not employed nearly enough in business families. A Board of Directors (34%), a Shareholder’s agreement (31%), and family meetings (30%) are the most common governance structures. Family meetings are more prevalent (40%) in family businesses that are currently multi-generational. Establishing key governance structures are a must for business families, starting from generation 1.

Family Investment Office

According to RBCs North American Family Office Report 2021, the family office landscape continues to grow and evolve. Some pertinent statistics include:

- North American family offices’ top three governance priorities for the next 12 – 24 months are risk management (65%), investment governance & valuation policies (62%) and human capital oversight (40%).

- Only 50 percent of North American family offices have a succession plan in place, and only 48 percent are formally written. This may help to explain why 27 percent of family offices feel unprepared for succession

- 70% of North American family offices are involved in the families’ philanthropic giving. The average amount they gave for this period was USD$9.3 million, while the top causes they supported were education and health (93%), and economic and social impact (55%)

When it comes to family office governance, the top 3 priorities for families in North America over the next 12 to 24 months are:

- Improving the communication between family members and the family office (67%)

- Educating family members about the family offices’ activities (53%)

- Implementing a succession plan (39%)

- Educating family members about becoming responsible shareholders (39%)

A successful continuity plan for a family enterprise requires ongoing planning, and a future-based vision to ensure that the baton is handed off to family members prepared to understand their role and responsibilities to carry on the legacy. It is something that needs to be done with the family, for the family. But it doesn’t need to be done solely by the family, as FEA professionals are available to work with a family to help facilitate the continuity process.

[1] https://familyenterprise.ca/wp-content/uploads/2020/01/FEX-2019-Report-Family-Enterprise-Matters.pdf