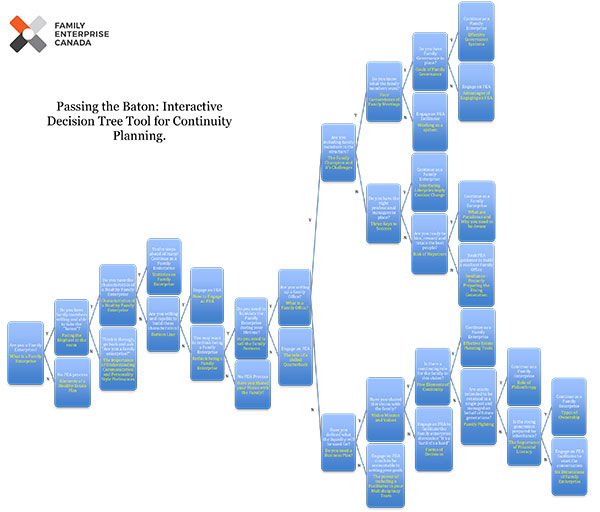

Passing the Baton: Interactive Decision Tree Tool for Continuity Planning

Passing the Family Enterprise Baton

A Decision Tree Tool Can Help

This Decision Tree Tool is thought provoking and comprehensive. We strongly advise that you take your time and reflect on each question before you answer. Articles for each question are included, which will help you put the question in the proper context before answering.

If you ever find yourself unable to answer a question, don’t worry, there are always additional resources available to you in your Resource Centre. If you decide that it would be best to work with an advisor on this tool, explore the FEA Directory and find a qualified FEA to help you through this process.

This Decision Tree was developed by Danielle Saputo and Jeff Halpern, in collaboration with Family Enterprise Canada

Danielle Saputo

Danielle is a Life Learner dedicated to bringing out the best in herself and others. As a Family Advisor she is clarifying purpose, resolving conflict, and amplifying total wealth, where wealth is much more than financial capital – the focus here is on Human Capital.

The basis of her family advisory role is: “Are you communicating in a way that the family is in Harmony?” As a professionally trained Coach, Danielle’s goal is to hold a safe space for her clients. She provides accountability, clarity and support on their journey of self-discovery and forward motion. The basis of her coaching is: “Are you living the Legacy you want to be remembered for?”

Danielle also engages at speaking events sharing her story, knowledge and experience to help other Canadian families overcome the proverbial saying; “shirtsleeve to shirtsleeve in 3 generations”.

Jeff Halpern

Jeff is an experienced Business Succession Advisor who holds the Chartered Professional Accountant/Chartered Accountant designations with cross-border tax and estate planning experience.

Jeff has been actively focused on helping high net worth business owners plan for the future transfer of ownership and control of their businesses to their chosen successors, as well as ensuring the co-ordination of various TD Specialists (i.e investment, banking, insurance, trust) in the succession process. Jeff has gained extensive experience while working in America, Asia, and Europe over almost 4 decades.

- Wait! We need a little informationBefore you start, we just need a little bit of information. This will help us better serve you in the future. If you're currently a member, just click the 'Log In' button below to get started.

or Login

Are you part of a family enterprise?ArticleWhat is a 'Family Enterprise'?

Do you have family members willing and able to take the 'baton'?ArticleFacing the Elephant in the Room

No FEA Process

Do you have the characteristics of a Healthy Family Enterprise?

Think it through, go back and ask 'Are you a family enterprise?'

You're steps ahead of many! Continue as a Family Enterprise

Are you willing and capable to build these characteristics?ArticleBottom Line

Engage an FEA

You may want to rethink being a Family Enterprise

Do you need to liquidate the Family Enterprise during your lifetime?

No FEA Process

Are you setting up a family Office?ArticleWhat is a Family Office?

Engage an FEA

Are you setting up a family Office?ArticleWhat is a Family Office?

Are you including family members in the structure?

Have you defined what the liquidity will be used for?ArticleDo you Need a Business Plan?

Have you shared the vision with your family?ArticleVision, Mission and Values

Engage an FEA coach to be accountable to setting your goals

Do you know what the family members want?

Do you have the right professional managers in place?ArticleThree Keys to Success

Is there a continuing role for the family in this vision?ArticleFive Elements of Continuity

Engage an FEA to facilitate the family enterprise discussion 'It's a hard it's a hard'ArticleForms of Decisions

Do you have a Family Governance in place?ArticleGoals of Family Governance

Engage an FEA facilitatorArticleWorking as a system

Congratulations!

Continue as a Family Enterprise

Are you ready to hire, reward and retain the best people?ArticleRisk of Nepotism

Congratulations!

Continue as a Family EnterpriseArticleEffective Governance Systems

Engage an FEAArticleAdvantages of Engaging an FEA

Congratulations!

Continue as a Family Enterprise

Seek FEA guidance to build a resiliant Family Office

Congratulations!

Continue as a Family EnterpriseArticleEffective Estate Planning Tools

Are assets intended to be retained in a single pot and managed on behalf of future generations?ArticleFamily Fighting

Congratulations!

Continue as a Family EnterpriseArticleRole of Philanthropy

Is the rising generation prepared for inheritance?

Congratulations!

Continue as a Family EnterpriseArticleTypes of Ownership

Engage an FEA facilitator to start the conversation

At this point, we suggest you take a short pause to reflect on the decisions taken so far, and consider:

- What areas need improvement in the characteristics of your family enterprise?

- Discuss a plan of action with a timeline

- Prioritize this plan of action list

At this point, we suggest you take a short pause to reflect on the decision takens so far, and consider:

- What job description would you develop for a skilled quarterback?

- Define the necessary roles and responsibilities in your family ecosystem

- Consider the different hats that you wear

At this point, we suggest you take a short pause to reflect on the decision takens so far, and consider:

- Reflect on the roles and responsibilities

- Be clear on each family member’s desires

- What will you focus on in the four cornerstones of family meetings?

- Set smart goals and have accountability

At this point, we suggest you take a short pause to reflect on the decisions taken so far, and consider:

- Is there alignment across your family?

- Is there forward motion and buy-in?

- Reflect on your journey and celebrate you and your family!

Congratulations, you have completed the Decision Tree!There were many decisions made and a lot of information to reflect on.

Take note of your family journey. At this stage, your family should feel that they are the same team, moving in the same direction as a cohesive unit.

Feel free to re-take the Decision Tree anytime you wish to dive deeper into the information, articles and key decisions presented.

*For the best experience, please complete this activity on a laptop or desktop computer.

To be a healthy family enterprise the following characteristics are needed.

- Communication is open and clear

- Family has the ability to resolve conflict

- There is high trust between family members

- Goals and values of the family are clear and documented

- The boundaries between family and business are clear

- Succession is planned early

- There is a functioning independent board of directors