Resilience – Properly Preparing the Rising Generation

You’ve taken a journey with us through this decision tree and our objective is to educate you on the way. We’ve shared our knowledge and outlined areas to further dive deeper into so that you can be best prepared in passing the baton.

At this stage you’ve said yes to wanting to set up a Family Office. And you replied no to a series of questions. These included: No to Are you including family members in the structure, No to Do you have the right professionals in place, and No to Are you ready to hire, reward and retain the best people.

Now, you may have all kinds of reasons for having answered no to these questions. Too often it is because we have not taken the time to plan. We don’t take the time to ask some simple questions and map out the road ahead. And this is where resilience plays its role.

Resilience in the capacity to recover quickly from difficulties. Psychologists define resilience as the process of adapting well in the face of adversity, trauma, tragedy, threats, or significant sources of stress-such as family and relationship problems, serious health problems, or workplace and financial stressors. Do you give yourself and/or your children enough opportunity to test their own resilience?

According to Dr. Ginsburg, a child pediatrician and human development expert, there are 7 integral and interrelated components that make up being resilient:

- Competence

- Confidence

- Connection

- Character

- Contribution

- Coping

- Control

How many of these components have you helped nurture in yourself? How many have you nurtured into your rising generation?

I find it very unfortunate when I come across families who have children well into their 50s who still feel they have no control over their life. There is the constant dangling of the proverbial carrot “DO as I say or else.” Or I hear the following generation comment “Dad still controls everything and will continue to control from the grave.” This is not where you want to be if you are serious about being a family enterprise and setting up a successful continuity plan.

It is time to buckle down and put pen to paper – what is it all for? Past the business, the wealth accumulated, what do you see for your family? Can you answer these questions in 7 words or less? Truly be clear on what you want for your loved ones and share that vision? The fact is that there is no correlation between successful succession planning and successful succession.

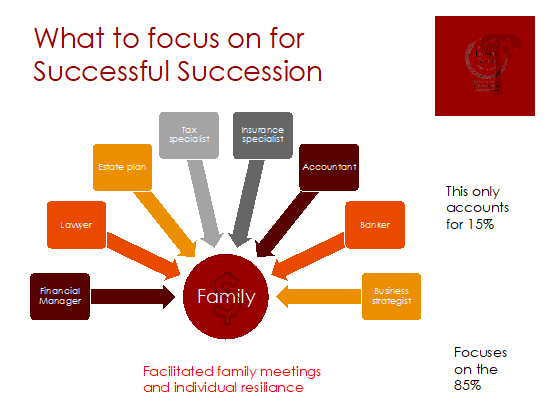

You can have all your advisors: financial managers, lawyers, estate plan specialists, tax specialists, insurance specialists, accountant, banker and business strategist, with their “I’s” dotted and “T’s” crossed but that only accounts for 15% of a family enterprises success. What about the other 85%?

Taking the time to properly prepare the rising generation, giving them a chance to practice resilience, communicating your vision and outlook for the family’s future. What are their passions and interests? What skillsets do they have, and which ones do they need to develop more? How do they learn and how can you engage them in the type of learning that is best for them? Continuity planning is essential, and a parallel process of preparing your next generation is as important to the family legacy. This is where 85% of a family enterprise’s success lies.

This can all begin with seeking the guidance of a skilled FEA to help build a resilient Family Office. It might start by focusing on the Business Circle, taking the time to build an effective business plan, with a clear mission vision, a profit and loss forecast to support the investment in manpower needed to staff it up, and the projections of revenue to pay for the upkeep. This can then be presented to the family circle members to get them excited to support the plan.

And if you are aiming to be a trans-generational family you will have to pass on the entrepreneurial mindset and capabilities to your next generation. You will have to encourage new streams of wealth across many generations. And you have to sustain the family as the trans-generational engine. Give your rising generation the chance to be resilient. This takes work and is much harder than building your business. If you have the will there is definitely a way.

Decision Tree Question: Seek FEA Guidance to Build a Resilient Family Office