What is a “Family Enterprise”?

Welcome to the world of Family Enterprise continuity planning, the subject matter focus of Family Enterprise Advisors. The very first question each family should ask itself along the planning path is, “Are We a Family Enterprise”?

A family enterprise is much more than a family business, as it comprises the holistic dimensions of the family unit, together with all aspects of the family wealth, including the operating business and /or family office, financial assets, real estate, heirloom assets (e.g. cottages, art, horses and the like), philanthropic interests, deferred assets like life insurance, and human/non-financial assets such as the human, intellectual, social, and spiritual values of the family members.

A family enterprise can include the active investment of the sale proceeds from the disposal of a family business or real estate portfolio, where the reinvented family business is now an investment business, or family office with a long-term continuity goal.

A family enterprise typically requires shared family assets, a goal of growing the assets further, and a commitment to continuity, ie; passing assets from one generation to the next. As a family enterprise, you work with the principle that “the whole is greater than the sum of your parts.”

Family enterprises have a unique advantage, often called the “familiness advantage”. This advantage comes from the integration of the family, its individual family members, and the business with one another. This combination of attributes brings a competitive advantage that often cannot be easily copied, benefitting from the interfacing of the resources of all family members.

When several multi-generational enterprise families were interviewed to help explain why they were so successful in transitioning their enterprises over so many generations, the answer most frequently cited was that “we put the family enterprise above ourselves.” They successfully implemented governance techniques to enable decisions and actions to be made within the wider family group for the welfare and best interest of the family enterprise, rather than just for themselves as individuals. That is a very important principle for continuity.

The characteristics needed for a long-term healthy family enterprise include: strong open communication, an independent Board of Directors, transparency and high trust among all interested parties, a formal succession plan, strong leadership with performance measurement, clear boundaries, good corporate governance mechanisms, an alignment of purpose between individual and family, and above all shared values. It takes time and a lot of effort to put these into place. As well as having a commitment to putting the family enterprise above one self.

If it were easy to be a successful multi-generational family enterprise, more families would have chosen this route, and fewer families would have sold off their valuable businesses or avoided open conflict. But the truth is, successful continuity is not easy, as it requires collaboration, trust, hard work, and the help of skilled family enterprise advisors to guide the process. And it involves ongoing risk that the next generations may not be able to perpetuate the success of the founders or generation that preceded them, with the work ethic and determination required of them. And thus, sometimes, the best decision for a family is to sell. Selling an operating business does not terminate a family enterprise, and should not be looked up as a failure, since the substantial proceeds of sale can be used to create a family office enterprise, with new opportunities for continuity for the future generations. It is one of the reasons that so many family offices are being created these days. Also, we emphasize that selling a business does not stop a family from being a family enterprise. If there are still shared assets the family enterprise continues, and the work still needs to be done unless the choice is to distribute assets to individuals with no shared ownership.

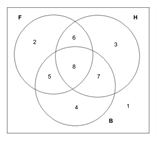

A successful family enterprise requires an understanding that there are 3 key and very separate interested parties who need to be considered in relation to succession planning of a family enterprise, including 1) Family Members, 2) Owners, and 3) the Business (i.e. management), called “the 3 Circle Model”. The 3 Circle Model was developed at Harvard Business School by Mesrrs. Taguiri and Davis. The 3 circles overlap and produce a Venn diagram, producing in fact 8 different perspectives to consider when optimizing family enterprise planning.

Issues and challenges can arise in all 3 circles, including voice versus vote, fair versus equal, conflicting visions/goals, rivalry, governance shortcomings, communication and relationship breakdown, the need for formal written agreements, conflict management, alignment of strategy, performance measurement issues, clarity of policies, need for member education, trust and control issues, and nepotism. With the design of good governance mechanisms in all 3 circles, it is easier to assure a positive long term continuity plan.

In the absence of good long-term planning, and an understanding of the key questions that families must ask, there is a tendency for clashes to arise, which can lead to a preference to sell the family enterprise.

Once you determine that you are a family enterprise, you can follow the decision tree we have developed as a roadmap to help you decide on the right path to continuity and a workable transition strategy. And don’t forget to use the expertise of a Family Enterprise Advisor (FEA) to help the family navigate the potholes in the journey, as sometimes an outside facilitator can greatly help to overcome the natural resistance to working as a team for the betterment of the family enterprise.

Decision Tree Question: Are You a Family Enterprise?